This essay is part of a series about Ralph Borsodi and his book, Inflation is Coming And What to Do About It. Click Here to go to the beginning of this series.

###

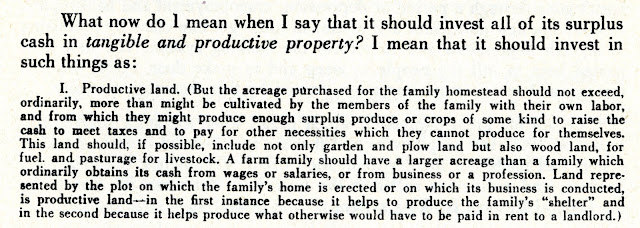

In the previous part of this series, Ralph Borsodi urged Americans with money in the bank to withdraw it and convert it into tangible and productive property. In this excerpt, he provides many examples...

After this part of the book (of which there is more than I have shared with you here), Borsodi discusses the matter of what a family should do with its stocks and bonds in order to avoid their becoming worth less and less as inflation comes. His concedes that in a time of inflation, good quality stocks in companies with a record of profit can pace inflation. However, his advice is best summed up in these excerpts...

From the subject of stocks and bonds, Borsodi moves into the matter of life insurance. He is not opposed to having life insurance, but he is opposod to purchasing life insurance policies that have "compulsory investment elements" in them. He advises that such policies be cashed out and the money used to purchase productive property (as outlined above). Then, purchase Term life insurance.

I'll share Ralph Borsodi's final words of advice from this book in the next part in this series.

To go to Part 11 (the conclusion)

of this series.

Elizabeth L. Johnson said,

ReplyDeleteIt's interesting how things come back to the basics of life. It's like mankind makes life fancy and all made out (industrialism, technology, and such). It takes many years, and then it all fails and returns back to basics: man, his land, and his God.

This has been an interesting and thought provoking series. Thanks for sharing what you've been reading.

ReplyDelete